THE LEGAL SYSTEM

|

THE TAX SYSTEM

|

CORPORATE TAXATION

|

| Common Law system |

Investor friendly tax system |

12,5% corporate tax on trading profits |

| Principles of Equity apply |

Taxation based on Residency status |

No tax on dividend income (subject to conditions) |

| Cyprus Companies’ Law based on 1948 UK Companies’ Act (updated) |

One of the most favorable tax systems in EU, both for companies as well as for individuals |

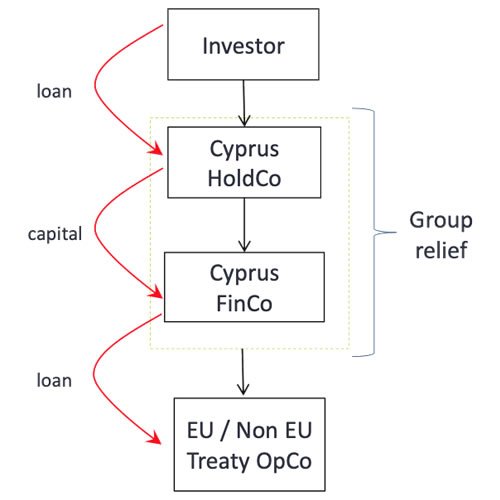

Notional Interest Deduction (NID) available for new capital introduced |

| English case law closely followed – cases have persuasive effect |

Tax base for hundreds of thousands of individuals and their companies |

Intangible Property (IP) Regime in line with OECD’s “nexus” principle |

| European Court of Justice decisions binding |

Tax legislation EU & OECD compliant |

Corporate tax on sale of securities: 100% exemption |

| Capital markets legislation harmonised with EU Directives and Regulations |

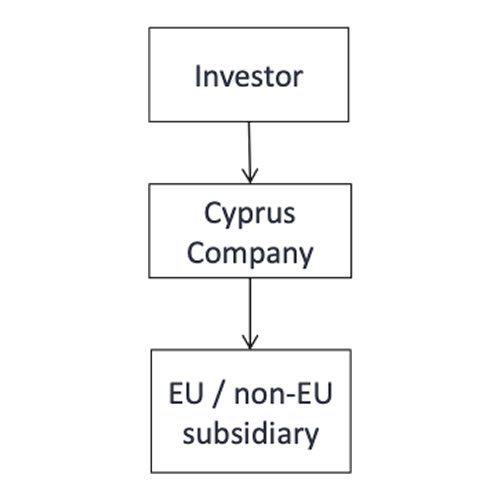

EU Tax Directives apply |

No withholding tax on outgoing payments (dividends, interest, royalties) |

|

Extensive double tax treaty network |

Foreign exchange differences are tax neutral |

|

|

Group relief availability (for 75% holdings) |

|

|

Tax exempt re-organisations |

|

|

Advanced tax ruling practice offers safety and predictability for investments |